Writer | 宏Sir

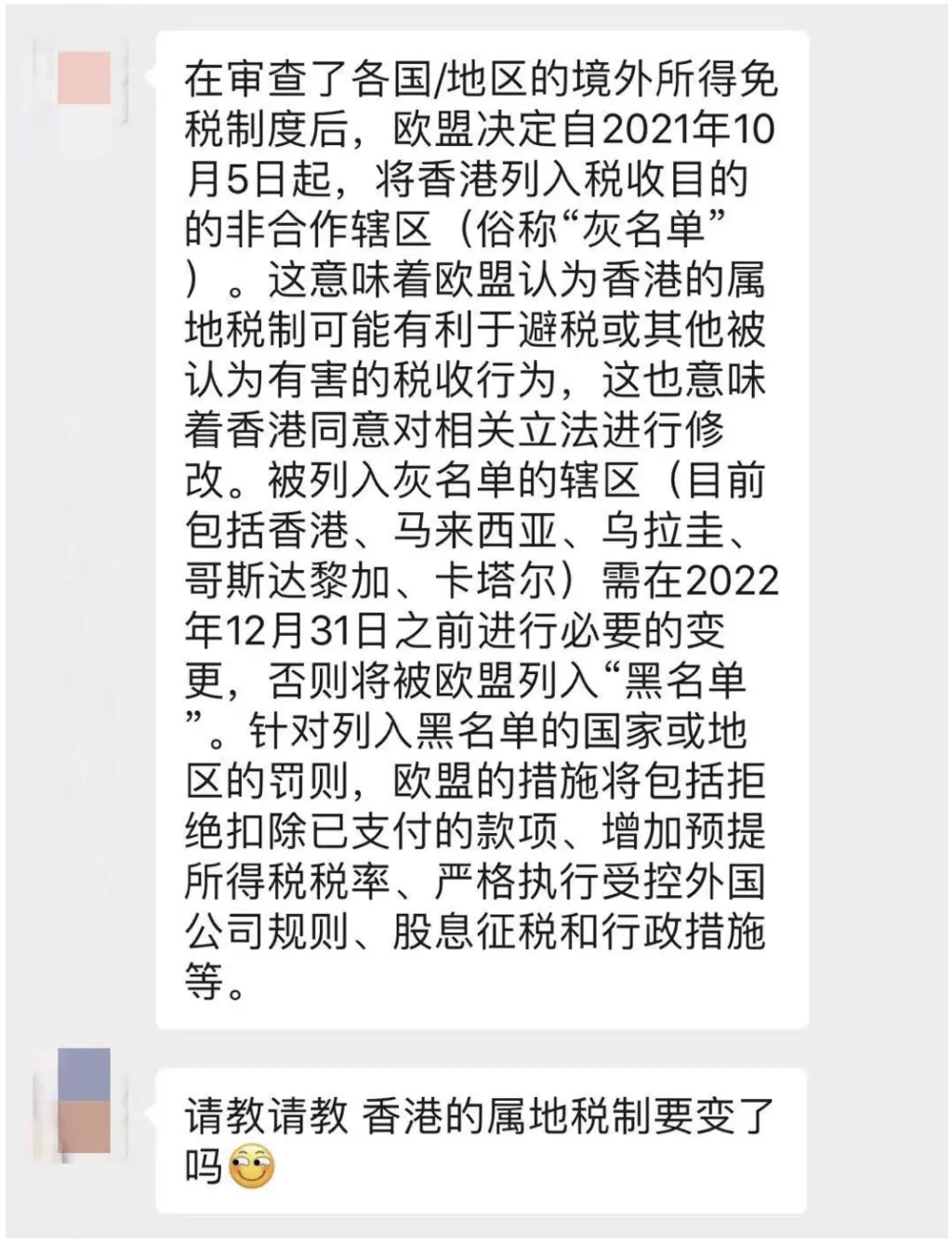

Effective from October 5, 2021, Hong Kong SAR has been added to the EU's 'grey list' of non-cooperative jurisdictions for tax purposes since the European Union considers aspects of Hong Kong’s territorial tax system may facilitate the phenomenon of “double non-taxation”.

A spokesman for the Government of HKSAR states that Hong Kong adopts a territorial source principle of taxation for the past years. Only profits which are sourced in Hong Kong are taxable while profits sourced elsewhere are not subject to Hong Kong Profits Taxation. To line up with the EU’s standards, Hong Kong will amend the Inland Revenue Ordinance by the end of 2022 and implement relevant measures in 2023.

Being put on the 'grey list' by the EU again will naturally have a certain negative impact on Hong Kong's reputation. However, the inclusion of Hong Kong onto the 'grey list' will not result into Hong Kong enterprises being subject to any defensive tax measures before the legislative amendments and enforcement in 2023.

By comparison, tax on corporate income in Singapore is imposed at a flat rate of 17%. However, companies in Singapore can take advantage of a tax exemption on the first $200,000 of income for their business. The corporate would have a lower tax burden which under 17% in practice. Why EU doesn’t enclose Singapore onto the 'grey list’ as well?

The reason is that there are certain qualified exemptions by foreign sourced income in Singapore, such as dividends, interest, and service fee. It’s not just a simple "territorial source principle".

It is predicted that the territorial source principle of Hong Kong company taxation will continue to maintain after Singapore-style adjustments have been made in the near future.